How to Promote Snacks & Candy in the World of Online Grocery

It may seem that impulse buys are on the decline in a click and collect world, but brands simply need to use new marketing strategies to increase sales.

Today’s food and beverage consumers are going to the physical grocery store less and less. Weekly grocery trips are down 27% since 2012. This is due in large part to the explosion of online grocery sales from retailers like Amazon with innovations in grocery delivery and Walmart with multiple “click and collect” ordering options. Walmart’s expansion of online grocery pickup has disrupted the grocery e-commerce market by making its ordering and fulfillment processes as smooth as possible. With this growth in online grocery sales, it would seem to reason that impulse buys would be down. Consumers aren’t confronted with products while physically in the store. In fact, U.S. consumers are 5% more likely to make an impulse buy in the grocery category online than in a physical store. To make sure that snack and candy brands are one of those impulse-buys online, it requires tactical marketing strategies to convince consumers to add a treat to the cart.

U.S. consumers are 5% more likely to make an impulse purchase in the grocery category online than in a physical store.

Nielsen, Understanding Today’s Online Omnishopper, 2017

Entertain Consumers with an Always-On Content Approach

Now that consumers can buy products whenever they want, brands must find new ways to stay top of mind. This has lead many snack and candy brands to develop new marketing ideas that keep them engaged with the consumer. Digital marketing has opened up opportunities for brands to target consumers with laser-focus and capture them when they are at the point of purchase. Christina Blaisdell, Digital & eCommerce Manager at Amplify Snack Brands suggests that brands must make sure that all of their owned channels – such as social and brand websites – are constantly pushing home their repeat and appointment snacking message. Blaisdell heads up digital commerce for such snack brands as SkinnyPop, Pirate’s Booty and KRAVE Gourmet Meat Cuts. “We really try to convey the concept of guilt-free snacking in a way that lends to regular satisfaction. We want people to know that they can use our products often and it’s not just an indulgence.”

“We really try to convey the concept of guilt-free snacking in a way that lends to regular satisfaction. We want people to know that they can use our products often and it’s not just an indulgence.”

Christina Blaisdell, Manager Digital & eCommerce, Amplify Snack Brands

By leveraging photo-and video-centric platforms like Facebook and Instagram, snack companies can entertain consumers with content that builds brand loyalty. Types of content that perform best are usually those that evoke some emotion, funny memes or emotional childhood moments relived. This helps cement the brand in consumers’ minds.

Build Relationships with Loyal Followers with Snackable Emails

Another tactic to stay on consumers’ minds is email marketing. Email is an excellent channel for communicating with consumers as they have given their permission to communicate on a regular basis. National holiday emails are great to remind subscribers that snacks or candies should be high on their list for holiday shopping. Remember to be sensitive to the audience’s cadence with email promotions to ensure they don’t feel overwhelmed by too many emails too frequently. Blaisdell sees email and social as great platforms to even promote your other sales channels like Amazon when running promotions. “We want to reward those loyalists that are listening to us, so we’ll share with them that we have a great offer running on Amazon, or we have a new item that they can get on Amazon with a lower risk trial by applying a coupon or taking advantage of friendly shipping options.”

Reach Them at the New Checkout Line with Grocery Apps and E-Commerce Advertising

Although grocery e-commerce stores don’t have the luxury of a consumer standing in a checkout line staring longingly at the surrounding snacks, they do have the luxury of up-sell and cross-sell technology in their online experiences. Some brands have taken to paying for featured placement in users’ shopping apps. This is extremely important, as once users have acquired an item for their online grocery order many stores offer those purchases next time as a starting point. This moves an impulse buy to a regularly scheduled weekly order, making the recurring purchase extremely easy.

“We’ve seen that brands and products that fit into the daily routine have a really great repeat rate for online pantry stocking behavior.”

Christina Blaisdell, Manager Digital & eCommerce, Amplify Snack Brands

Eliminate Shipping Roadblocks to Lower-Dollar Purchases

Click and collect has thrived due to the convenience of ordering online and picking up in-store. That convenience is weighed against fees like shipping and delivery charges. Eliminating or lowering free shipping thresholds can encourage people to add lower-dollar items to their cart with no risk of affecting shipping. This is especially important to shipping-conscious consumers like Millennials and Gen Xers as they both continue to be the highest segment of click and collect consumers. Blaisdell sees that millennials are much more likely – than other age cohorts – to engage in a click and collect or a home delivery model. “We have to make sure that we’re showing up as consumer behavior evolves to these emerging models that represent a forthcoming bigger shift.“

Almost 50% of Millennials and Gen Xers see the value of click and collect as “convenience without the added shipping fee.

eMarketer; IRI, Consumer Connect Q4 2018

Snack Subscriptions and Stock Up and Save Offers

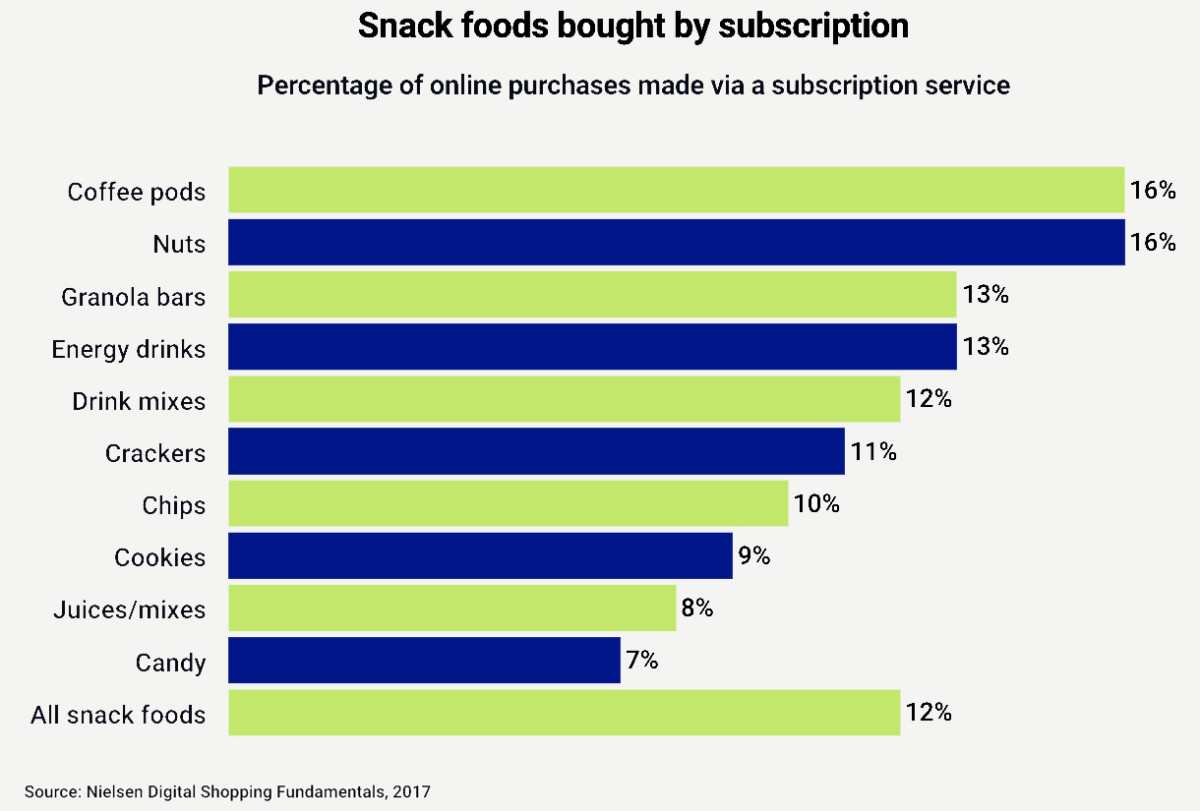

Many consumers would prefer to have their favorite snacks on hand for when that late-night craving hits. Many snack and candy marketing tactics should include promoting a subscription through services like Amazon or club services like Costco and Sam’s Club. Nielsen reports that 12% of all snack purchases online were made via a subscription service. This includes 16% of online purchases of nuts.

Blaisdell notes that brands should also consider what pack sizes are available to online consumers. “Our thinking is to offer our products in small bags, multi-packs, and variety packs to align with how consumers are purchasing online.” They may be looking to buy larger quantities to avoid multiple trips to the store between weekly orders. About 27% percent of consumers choose to buy snack foods in stock-up orders, which Nielsen says is a “realm of snack purchases that fosters impulsive, exploratory and open-minded consumer behavior.” Smaller grocery retailers may find this more difficult to offer because their online orders are usually drawn from the shelf or from back warehouses. Whole cases are also harder to restock often. Chip manufacturers and kid’s snacks have done this well by offering “family” or “variety” packs to give consumers both convenience and choice.

Snack and Candy Brands Must Employ New Marketing Strategies to Survive

While it may seem that impulse buys are on the decline in a click and collect world, brands just have to seize the new opportunities available to increase sales. “We talk about items and how they’re optimized for e-commerce, or how we can launch something on e-commerce first. Starting to think about how we market on e-commerce first, rather than it being an afterthought has been really critical for us,” says Blaisdell. Brands must consider always-on social and content marketing as well as other digital marketing tactics to entice people to put impulse items in their carts. Once a brand claims that coveted shopping cart space, they have the chance to be seen as a weekly staple by loyal consumers.